Use the 5 P's of Fraud Schemes to Spot a Scam

Scammers are resolute to steal more identities and personal information than ever before. These bad actors use a variety of tactics to steal private financial information. Once they have access to a credit card or bank account details, they can make unauthorized charges, drain your accounts, and steal your identity.

But when you recognize the five P’s of common fraud schemes, you can ruin their nefarious plans.

1. Fraudsters PRETEND to be from a known organization.

Scam artists often impersonate government organizations or companies you do business with, such as the Credit Union of Colorado. These criminals will also make up names that sound like well-known businesses or service providers and use technology to change the number displayed on your caller ID. Messages from the Credit Union will only include the web address hasv.electronic-fittings.com.

- Be on the lookout for links that look similar, contain extra letters or numbers, or may not even be related to the Credit Union domain.

- Using a different domain qualifier such as .top, .biz, or .online

- Message lacks details or is alarming in nature

- Poor grammar or spelling

- Requesting details not normally needed to log into online banking, such as social security numbers.

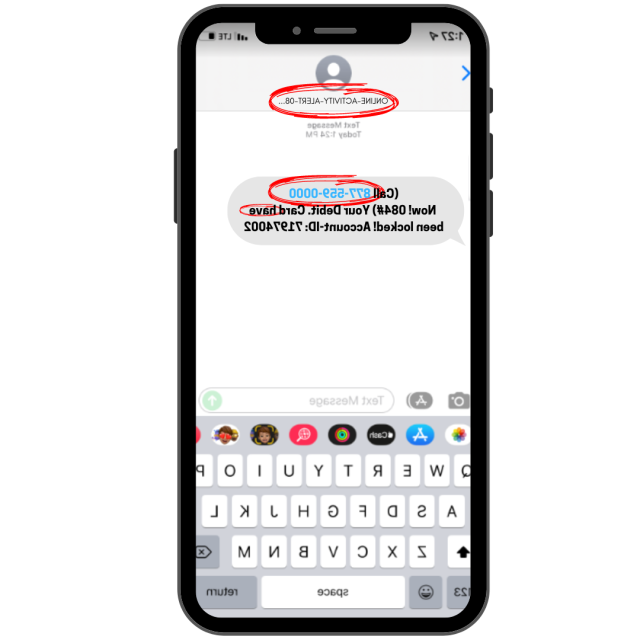

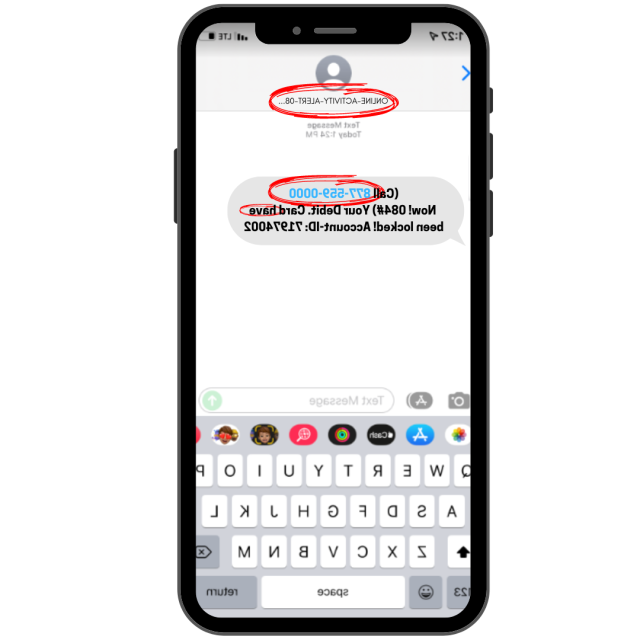

Here is an example of a recent scam text that has been circulating:

The Credit Union will never send out a message requesting a call back to a random phone number. Messages set from us will include Credit Union of Colorado. Be on the lookout for the following tells of a smishing message:

- Phone number is missing or is not a Credit Union Phone number.

- Requesting you call back a different phone number

- Content that is alarming but lacks details. Note that this example doesn’t even mention the Credit Union of Colorado

- Poor grammar or spelling in the message.

- Requesting your username/password or other sensitive information

- Requesting a One Time Passcode

2. Fraudsters say there’s a PROBLEM

These crooks know how to get your attention. They'll use scare tactics to get you to respond to demands for cash, gift cards, wire transfers, or account access. Victims are often convinced they need to open their wallets after being told they:

- Owe back taxes

- Are in trouble with the law

- Need to resolve an account issue

- Are at risk of being physically hurt

- Have a family member in a financial crisis

The scammer always claims to have the solution but will only provide it in exchange for your money or private financial information.

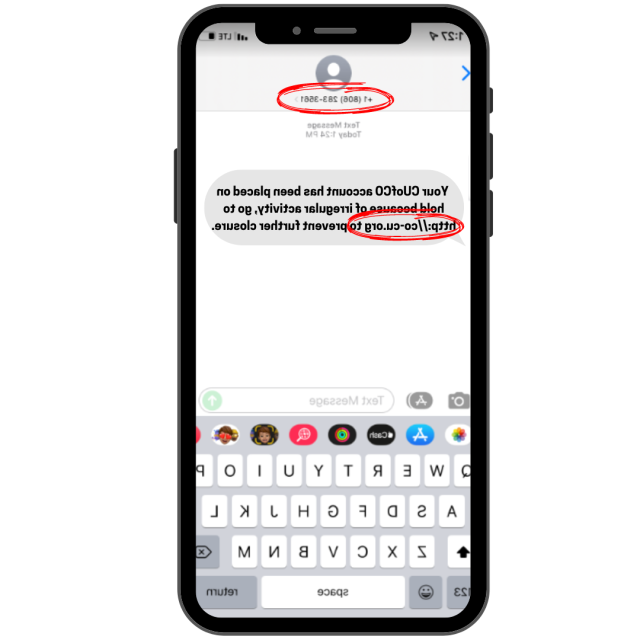

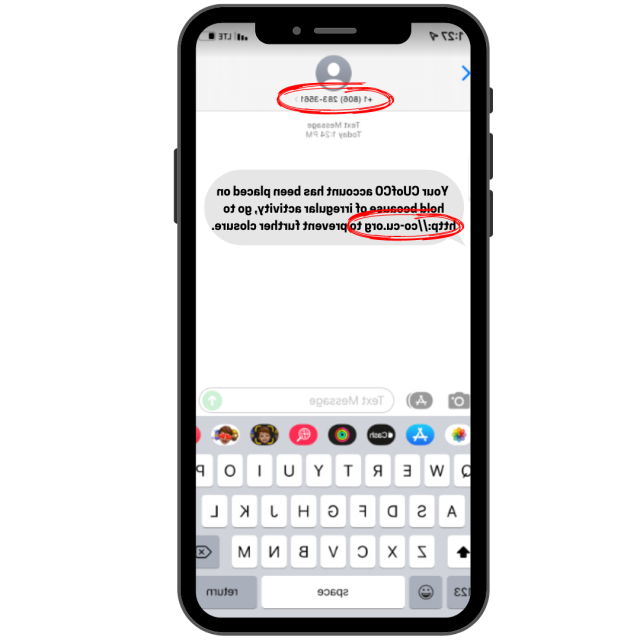

Below is an example of a recent text scam circulating. Notice the "problem" they are addressing. Also, the phone number is not recognizable, and the URL is not correct.

In some cases, a hacker will look for a response via text from their target. Be on the lookout for the following:

- The phone number is not one of the Credit Union of Colorados phone numbers

- The content of the message is alarming but lacks details (see below for a legitimate fraud txt message)

- Poor spelling or grammar

- Requesting your username/password via txt message

- Requesting additional details like a One Time Passcode or social security number

Below is an example of a legitimate fraud alert from the Credit Union regarding a fraud alert.

- The phone number remains the same each time

- There is a lack of urgency in the message (we can contact you later)

- There are no spelling or grammar mistakes

- The phone number to call remains the same between messages

- Contains clear details such as last four digits of your card number

3. Fraudsters PRESSURE you to act immediately.

Crooks want you to act fast and keep the communication secret. They might call, email or text with threats to arrest, sue, or humiliate you if you don't immediately do what they say. They don’t want you to take the time to verify their story.

The Credit Union will never send a message requesting a call back to a random phone number. Messages sent from us will include the Credit Union of Colorado. Be on the lookout for the following tells of a smishing message:

- The phone number is missing or is not a Credit Union Phone number.

- Requesting you call back a different phone number

- Content that is alarming but lacks details. Note that this example doesn’t even mention the Credit Union of Colorado.

- Poor grammar or spelling in the message.

- Requesting your username/password or other sensitive information

- Requesting a One Time Passcode

Below is an example of a recent text scam circulating:

4. Fraudsters tell you to PAY in a specific way.

Thieves often insist that you pay by cash, gift card, wire transfer, or virtual currency like Bitcoin. These payment methods are not easily traced or canceled. Some will send you a fake paper check for more than the amount needed, tell you to deposit it and instruct you to send them the difference.

5. Fraudsters ask you to claim a PRIZE.

Have you ever received an email, text, or phone call of congratulations for a contest or sweepstakes you don't remember entering? As enticing as the notification sounds, wise consumers ignore these attempts to lure victims into this common scam. Fraudsters will lie and say you've won the lottery or were approved for a free grant. But there's one big catch – you must pay a fee to claim your alleged prize.

How to Avoid Scams

Awareness is key to avoiding scams all year round. Before acting on any unsolicited request for personal information, remember:

- Impersonation scams take many forms. Government agencies and tech companies rarely call you out of the blue or send text messages demanding payment. If it's a legitimate request, they won’t mind if you call them back at the number displayed on the organization’s actual website.

- Fraudsters manufacture fake problems and emergencies. Confirm claims of out-of-town accidents and legal trouble by contacting family or local law enforcement. Look up the number. Do not call the number provided to you by a caller or the one that appears on your caller ID - numbers are frequently faked!

- Never pay to resolve a legal matter or claim a prize using virtual currency, cash, a wire transfer, or gift cards. These payment methods are hard to trace and are most often associated with fraud schemes. You may not be able to dispute or recall transactions you authorize, even if you later discover it was a scam.

- Credit Union of Colorado will NEVER ask you for a verification code, website password, or fully activated card number over the phone, via text message, or email! Whenever you contact a financial institution regarding your account, you may be asked to verify your identity in other ways. You should never divulge financial details to someone who calls you out of the blue.

- If it feels off, it probably is. Lotteries, loans, and jobs do not fall through if you ask for a few hours to consider. Trust your instincts!

If you believe you may be the victim of a scam, we recommend using our Fraud Checklist to recover the security of your accounts and possibly your identity. Contact us immediately at 800-444-4816 if you suspect fraud related to your Credit Union of Colorado account.

Below is an example of a real message from the Credit Union of Co

A legitimate message from the Credit Union regarding a fraud alert.

- The phone number remains the same each time.

- There is a lack of urgency in the message (we can contact you later)

- There are no spelling or grammar mistakes

- The phone number to call remains the same between messages

- It contains clear details such as the last four digits of your card number

Additional Resources

We encourage our members to stay alert to potential fraud schemes. Your best defense is awareness. Our Risk Department recently found these specific scams to be on the rise across the country: